How Commercial Insurance In Toccoa Ga can Save You Time, Stress, and Money.

Wiki Article

Things about Home Owners Insurance In Toccoa Ga

Table of ContentsAll about Annuities In Toccoa GaThe Only Guide for Insurance In Toccoa GaInsurance In Toccoa Ga Fundamentals ExplainedSee This Report about Home Owners Insurance In Toccoa Ga

A monetary advisor can additionally aid you choose how ideal to achieve goals like conserving for your child's college education and learning or repaying your financial obligation. Although economic advisors are not as fluent in tax legislation as an accounting professional might be, they can supply some guidance in the tax planning procedure.Some monetary advisors offer estate planning services to their customers. They may be trained in estate planning, or they might intend to collaborate with your estate lawyer to respond to inquiries about life insurance coverage, depends on and what need to be done with your financial investments after you pass away. Finally, it's important for monetary experts to remain up to date with the marketplace, economic problems and consultatory ideal methods.

To offer financial investment products, experts should pass the relevant Financial Market Regulatory Authority-administered tests such as the SIE or Series 6 tests to acquire their certification. Advisors that want to sell annuities or various other insurance items must have a state insurance policy license in the state in which they intend to sell them.

A Biased View of Home Owners Insurance In Toccoa Ga

You hire an expert who bills you 0. Due to the fact that of the regular fee structure, several consultants will certainly not work with customers who have under $1 million in possessions to be taken care of.Capitalists with smaller portfolios may look for a monetary advisor who charges a per hour cost rather than a percentage of AUM. Hourly costs for advisors typically run between $200 and $400 an hour. The even more facility your financial circumstance is, the even more time your advisor will have to commit to handling your assets, making it much more costly.

Advisors are proficient professionals who can aid you create a prepare for financial success and execute it. You may likewise think about getting to out to an expert if your individual monetary situations have actually lately become much more difficult. This can imply acquiring a house, marrying, having kids or obtaining a large inheritance.

Annuities In Toccoa Ga Fundamentals Explained

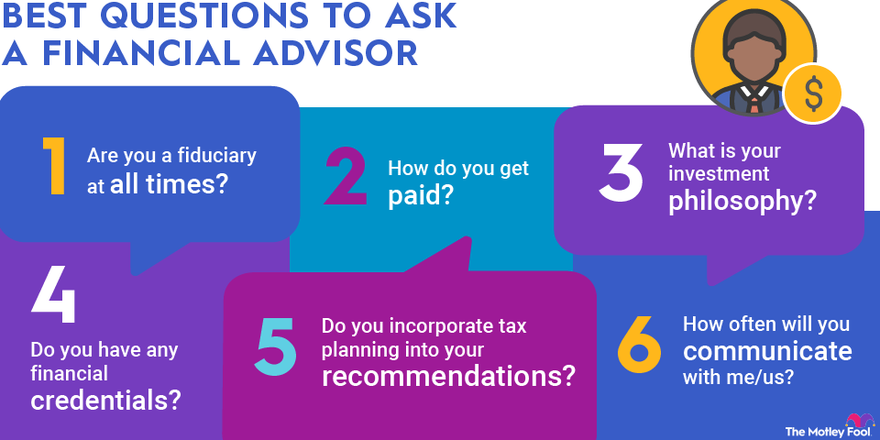

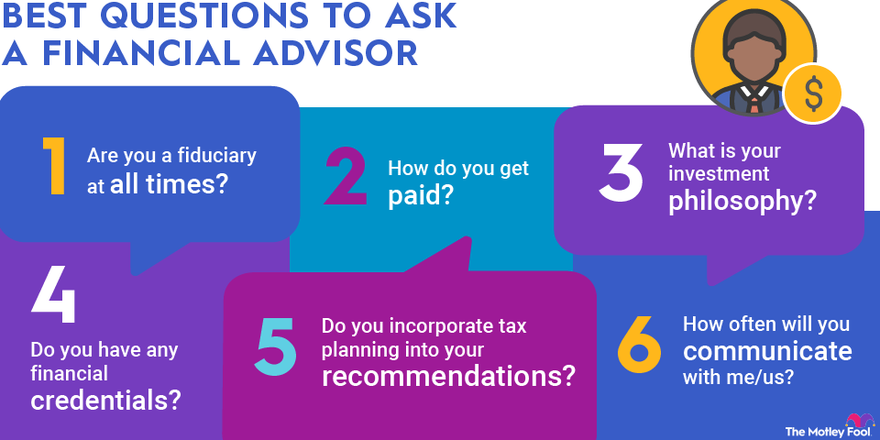

Prior to you meet with the advisor for a preliminary examination, consider what solutions are most important to you. You'll desire to look for out a consultant who has experience with the solutions you want.For how long have you been suggesting? What company were you in prior to you obtained right into financial encouraging? That makes up your normal client base? Can you provide me with names of several of your More Info customers so I can review your services with them? Will I be collaborating with you straight or with an associate expert? You might also intend to take a look at some sample financial strategies from the advisor.

If all the samples you're supplied are the same or similar, it might be an indication that this expert does not correctly customize their suggestions for each client. There are three primary kinds of economic recommending specialists: Qualified Monetary Coordinator specialists, Chartered Financial Experts and Personal Financial Specialists - http://www.video-bookmark.com/bookmark/5966316/thomas-insurance-advisors/. The Licensed Financial Planner specialist (CFP specialist) accreditation shows that an advisor has fulfilled a professional and honest requirement set by the CFP Board

Not known Facts About Annuities In Toccoa Ga

When choosing an economic expert, consider a person with a professional credential like a CFP or CFA - https://www.youmagine.com/jstinsurance1/designs. You may likewise take into consideration an expert who has experience in the solutions that are essential to youThese consultants are normally riddled with problems of interest they're more salespeople than advisors. That's why it's important that you have a consultant that functions only in your best interest. If you're trying to find a consultant that can truly offer actual worth to you, it is necessary to research a number of potential alternatives, not simply pick the given name that advertises to you.

Presently, many experts have to act in your "ideal interest," yet what that entails can be almost void, other than in the most egregious cases. You'll need to discover a real fiduciary.

"They should confirm it to you by showing they have taken serious recurring training in retired life tax obligation and estate planning," he claims. "You should not spend with any kind of consultant that does not invest in their education and learning.

Report this wiki page